Only 17% of individuals surveyed say they are “very confident” they will have enough money to live comfortably throughout their retirement years. At the same time, 36% were not at all confident. In 2001, Congress passed a law that can help older workers make up for lost time. But few may understand how this generous offer can add up over time.

The “catch-up” provision allows workers who are over age 50 to make contributions to their qualified retirement plans in excess of the limits imposed on younger workers.

How It Works

Contributions to a traditional 401(k) plan are limited to $20,500 for 2022. Those who are over age 50 – or who reach age 50 before the end of the year – may be eligible to set aside up to $27,000 for 2022 (up from $19,500 and $6,500 respectively for 2021).

Setting aside an extra $6,500 each year into a tax-deferred retirement account has the potential to make a big difference in the eventual balance of the account. And, by extension, in the eventual income, the account may generate.

Catch-Up Contributions and the Bottom Line

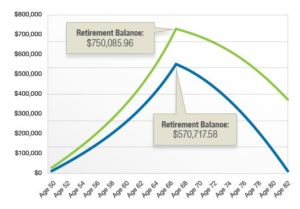

This chart traces the hypothetical balances of two 401(k) plans. The blue line traces a 401(k) account into which the maximum regular annual contributions are made each year, but no catch-up contributions. The green line traces a 401(k) account into which the maximum regular and full catch-up contributions are made each year.

Upon reaching retirement at age 67, both accounts begin making payments of $4,000 a month.

The hypothetical account without catch-up contributions will be exhausted by the time its beneficiary reaches age 83.

This hypothetical example is used for comparison purposes and is not intended to represent the past or future performance of any investment. Fees and other expenses were not considered in the illustration. Actual returns will fluctuate.

Both accounts assume an annual rate of return of 5%. The rate of return on investments will vary over time, particularly for longer-term investments. Contributions to and withdrawals from both accounts have been increased by 2% each year to account for potential 2% inflation.

Distributions from 401(k) plans and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59 1/2, may be subject to a 10% federal income tax penalty. Generally, once you reach age 72 (previously age 70 1/2), you must begin taking the required minimum distributions.